Tokyo: The New Epicenter of Global Risk and the Great Divergence

Tokyo is reshaping the global economy, driven by the BOJ's audacious rate hike and new regulatory warfare. Discover how these seismic shifts impact your investments, businesses, and the future of technology.

|  |  |  |

Tokyo: The Unseen Heart of Global Risk and the Dawn of "The Great Divergence"

For too long, our collective gaze has been fixed on the financial titans of New York and London, or the rising powerhouses of Beijing. But a profound shift is underway, one that will redefine the global economic landscape. Tokyo, often perceived as a quiet giant, is fast becoming the new center of gravity for global risk, holding the keys to both financial upheaval and technological revolution. Prepare for a rewiring of your understanding of global markets.

This isn't just about headline-grabbing events; it's about two seismic shifts converging to reshape how we conduct business, invest, and even how nations compete. We are at the precipice of what can only be described as "The Great Divergence."

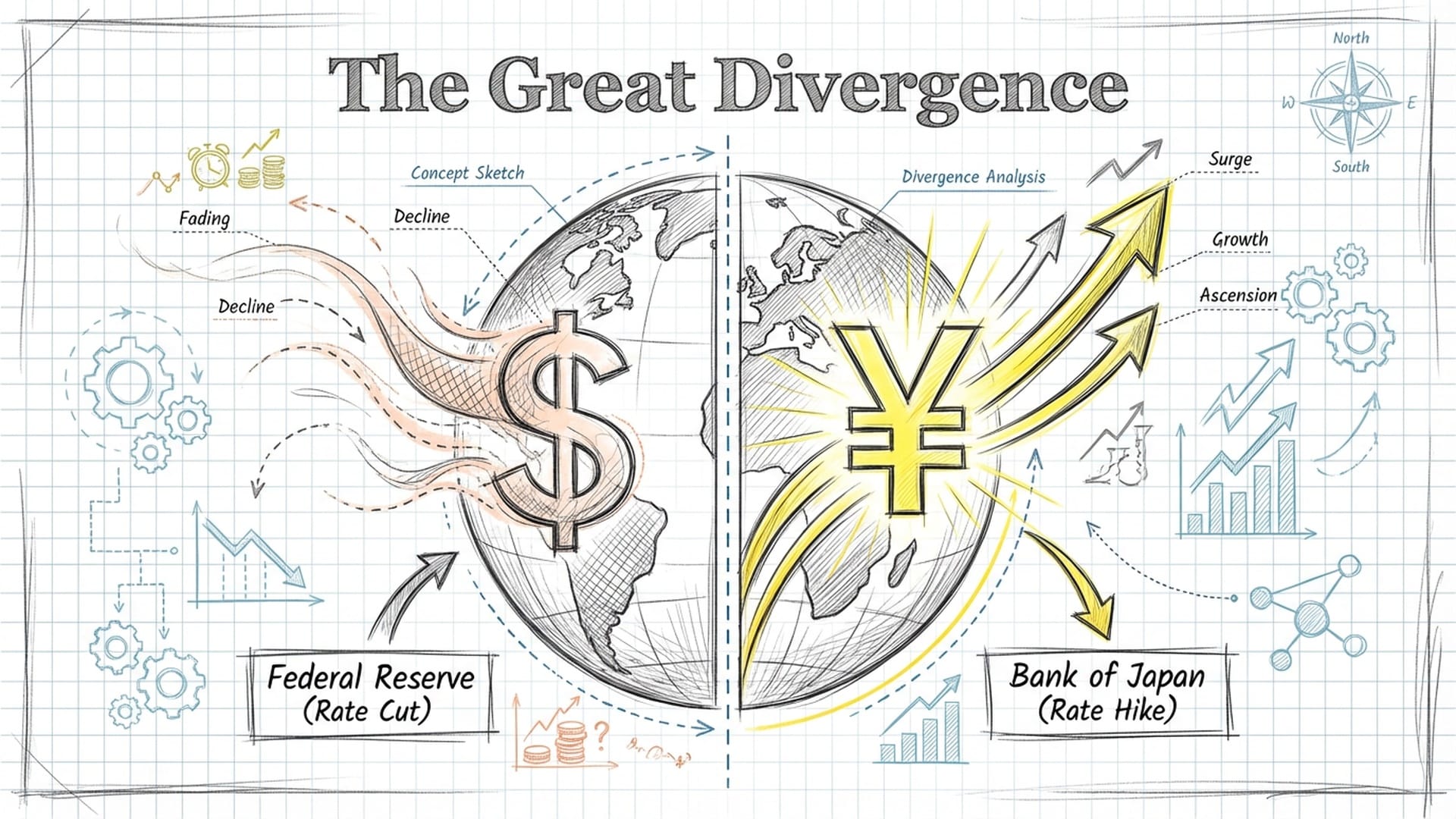

On one side, the Federal Reserve, long the world's most influential central bank, appears to be signaling a retreat from its hawkish stance. With whispers of rate cuts to a modest 3.50% to 3.75% range, the Fed seems to be waving a white flag against persistent inflation, returning to its familiar stimulative patterns.

But across the Pacific, the Bank of Japan (BOJ) has executed a maneuver so unexpected, so starkly un-Japanese in its audacity, that it has shattered decades of established financial doctrine. The BOJ has gone decidedly hawkish, hiking rates to levels not witnessed since 1995.

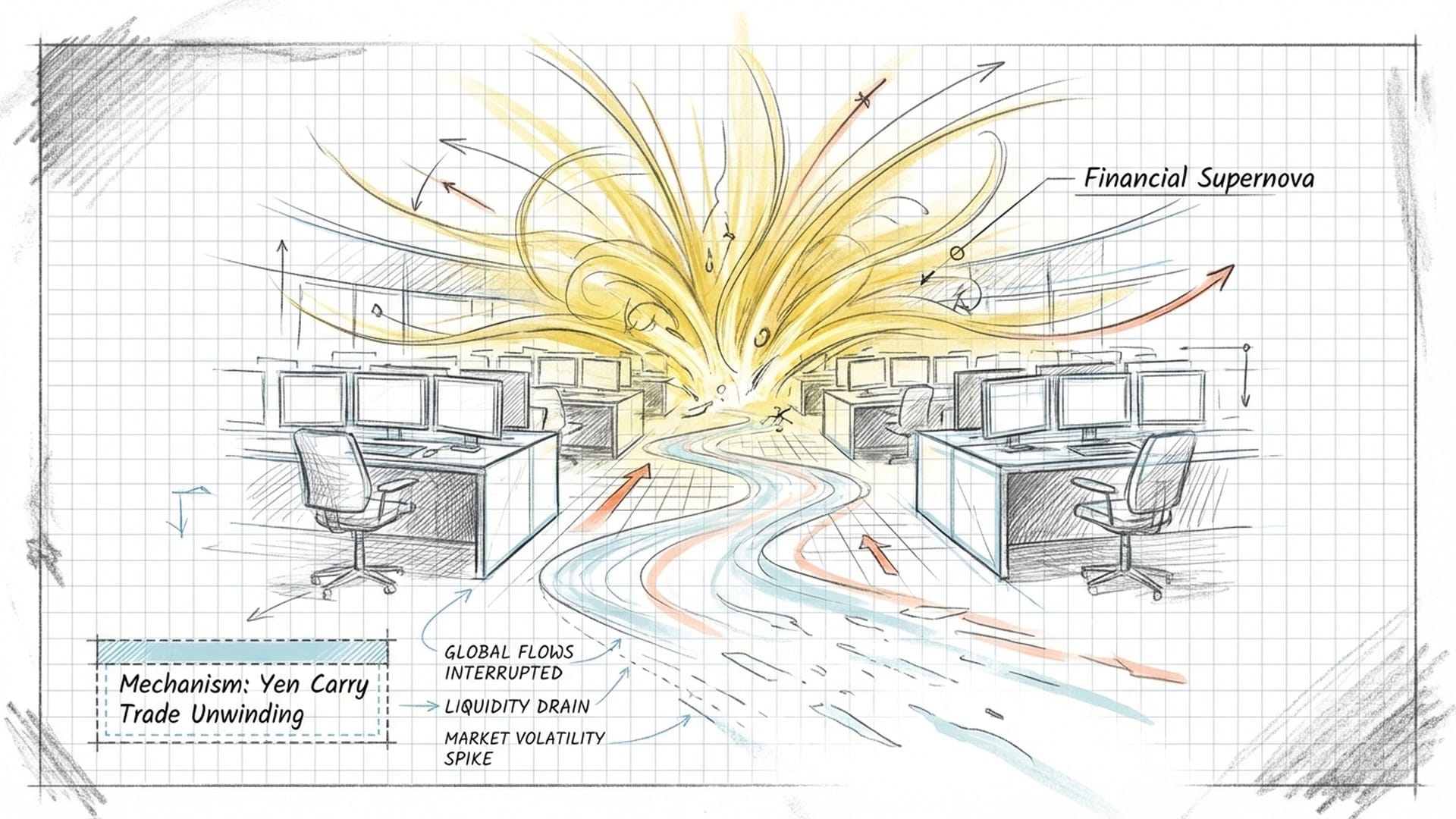

This isn't merely a policy pivot; it’s a financial supernova.

"This supernova has just obliterated the 'cheap Yen' carry trade. That’s the invisible river of liquidity that has been flowing globally, propping up asset prices everywhere, for years."

For decades, investors leveraged the practically free borrowing rates in Japan to invest in higher-yielding assets worldwide—a financial cheat code now abruptly disabled.

Beyond Money: The Rise of Regulatory Warfare

Yet, the transformation isn't solely monetary. While our attention has been drawn to traditional geopolitical conflicts and trade disputes, the very nature of global competition has evolved. We've transitioned beyond kinetic warfare and tariffs into an era of regulatory warfare. The battleground is no longer defined by bombs or battleships but by who sets the rules, controls the standards, and builds the protective moats around critical industries.

Consider recent developments: the "Tokyo Accord" on AI safety and the Global Semiconductor Alliance's "Green Chip Initiative." On the surface, these initiatives appear benign—ethical AI, environmental stewardship. Who could argue against them? However, beneath these seemingly noble declarations lies a profound truth: the next phase of global power competition will be fought with something far more sophisticated than tariffs: standardization and compliance.

The Era of Gated Sovereignty

We are rapidly moving from a world of open innovation to one of "gated sovereignty." Market access, the ability to sell products, indeed, one's very place in the global economy, will soon hinge on adherence to stringent ethical and environmental regimes dictated by powerful entities. For investors accustomed to frictionless capital and borderless technology, this represents a rude awakening. The new premium is not on speed, but on compliance, sovereign alignment, and understanding the new flows of liquidity. This is an absolute game-changer.

Let’s delve deeper into these critical events, as they are not just headlines, but direct impacts on your portfolio, your business, and your future.

The BOJ’s Historic Hawkish Pivot: A Supernova of Change

The Bank of Japan's decision was stark and unanimous: a 25-basis-point hike to a staggering 0.75%. While seemingly small, for Japan, this is an enormous leap, marking the highest rate since 1995. What makes it truly mind-bending is that it occurred precisely when major Western central banks, including the Fed and ECB, are contemplating easing. The BOJ chose to swim upstream.

Why this dramatic shift? The underlying logic signals the definitive end of Japan's decades-long deflationary mindset. Once synonymous with economic stagnation, falling prices, and a weak currency, Japan has turned a corner. Core consumer prices have consistently remained at or above 2% for over three years, and critically, significant wage growth is finally taking hold. The BOJ is no longer battling stagnation; it’s combating "bad inflation"—inflation driven by a weak currency that inflates import costs and burdens Japanese households.

This isn't just an economic shift; it’s a political one. Prime Minister Sanae Takaichi, initially perceived as dovish, has publicly supported this hike, a clear indication of the political pressure from citizens struggling with import-driven inflation. The BOJ is reasserting its independence, delivering a clear message to the world: "The era of the Yen as the world's funding currency, the cheap collateral for everyone else's leveraged bets, is coming to an end."

Immediate and Long-Term Repercussions

The short-term impact is undeniably bearish for global liquidity. Imagine a "Liquidity Vacuum" centered in Tokyo, suddenly drawing cash from around the world. The Yen has surged, triggering a rapid and painful unwinding of the Yen carry trade. Investors who borrowed Yen at near-zero rates to acquire higher-yielding assets—such as US equities or European bonds—are now facing margin calls. They must liquidate those assets to repay increasingly expensive Yen loans, exerting immediate selling pressure on global equities and US Treasuries. This is leverage being abruptly yanked out of the system.

Conversely, domestic Japanese banks are poised for a bullish setup. After decades of yield starvation, their net interest margins are expanding, allowing them to finally profit from lending.

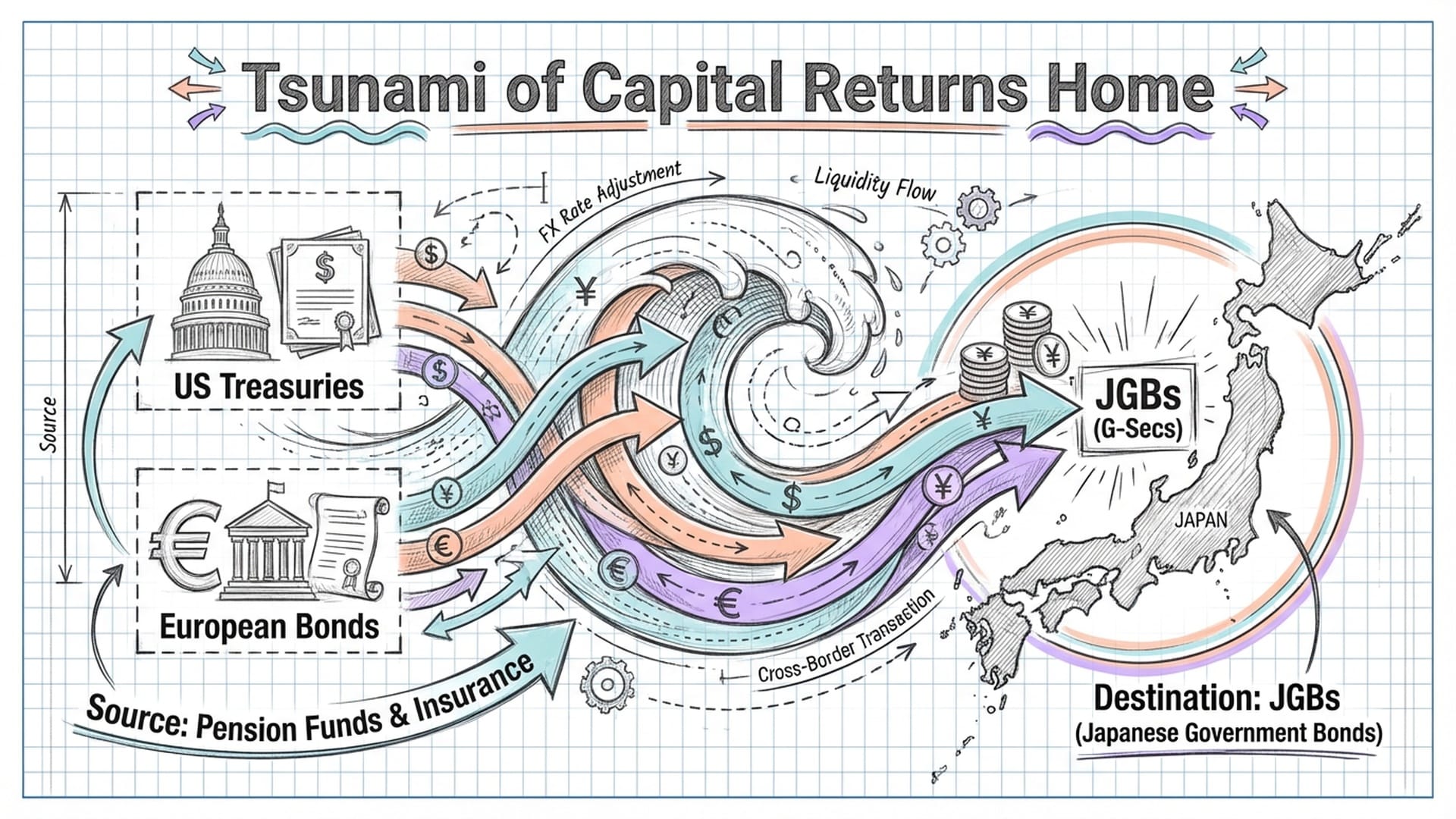

The long-term implications, however, are truly transformative. This marks the normalization of Japanese finance that has been discussed and debated for decades. Over the next 6 to 12 months, we anticipate a massive repatriation of Japanese capital. Japanese institutional investors—pension funds, insurance companies—who hold staggering amounts of foreign debt (from US Treasuries to French OATs) will likely begin shifting these funds back home to capitalize on rising domestic yields.

"Think about that: a structural increase in borrowing costs for Western governments. This isn't just a ripple; it's a tsunami for global bond markets."

Tech and Innovation: The "Tokyo Accord" and the AI Alignment Breakthrough

The "Tokyo Accord" and its AI alignment breakthrough present another layer of this global reordering. Ostensibly, it's a fantastic development: a consortium of leading global AI labs, under the new 'Tokyo Accord' banner, announces a breakthrough in AI alignment protocols. They’ve released an open-source Ethical AI Framework (EAF) with mandatory 'safety interlocks' to prevent emergent biases in Large Language Models. Safer, more ethical AI seems like a win for all.

But the underlying logic is far more Machiavellian. This is a brilliant, preemptive strike by Big Tech. Facing fragmented, potentially draconian regulations from various jurisdictions, major AI players coordinated. They effectively self-regulated by establishing an incredibly high technical bar that only they control. By open-sourcing the EAF, they’ve commoditized safety, saying, "Here's the standard, use it." But simultaneously, they’ve raised the barrier to entry for smaller, "rogue" actors. A startup simply lacks the resources, engineers, or capital to implement and comply with such a complex framework.

"This transforms 'AI Safety' from a vague philosophical debate into an industrial standard. It’s like saying, 'Here’s the new ISO certification for intelligence, play by our rules or don’t play at all.'"

The short-term impact is unequivocally bullish for major AI incumbents like NeuroGen and SynthMind. This accord drastically reduces their regulatory uncertainty, creating a "compliance moat" around their operations and paving the way for wider enterprise adoption. Companies can now confidently claim, "We're compliant with the Tokyo Accord."

Long-term, this is truly transformative. We are witnessing the birth of the ISO standard for intelligence. Over the next year, EAF adoption will become a de facto prerequisite for government contracts and enterprise procurement. If you want to sell your AI system to a Fortune 500 company, EAF compliance will likely be mandatory. This forces market consolidation. Startups unable to integrate these complex alignment protocols will face an impossible uphill battle, leading to acquisitions, marginalization, or failure. The strategic landscape shifts dramatically from "move fast and break things" to "prove safety to deploy," controlling the pace, direction, and profitability of future AI development.

Geopolitics: The "Green Chip" Blockade

Finally, let’s consider geopolitics and the "Green Chip" blockade. The launch of the Global Semiconductor Alliance’s "Green Chip Initiative" involves industry giants like TSMC, Samsung, and Western heavyweights. This new regime mandates incredibly strict sustainability and ethical sourcing audits for semiconductor production. Critically, compliance is now a prerequisite for GSA membership and, more importantly, for access to preferentially negotiated rare earth mineral supplies.

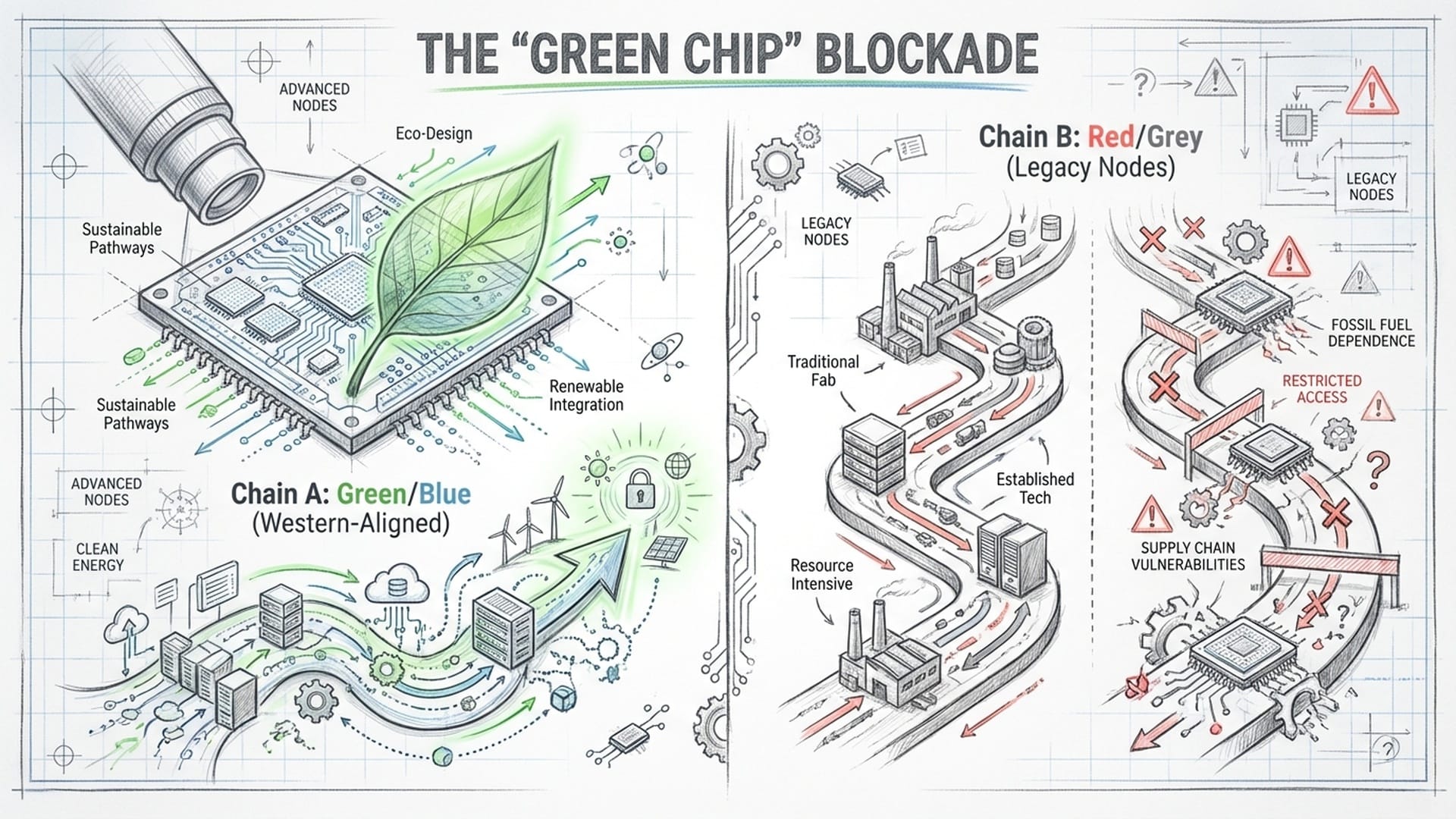

While framed as environmental stewardship, make no mistake: this is a strategic geopolitical maneuver—a "soft blockade." By setting capital-intensive sustainability standards, the GSA is effectively locking out competitors from nations with lower environmental standards or opaque supply chains. They are weaponizing ESG criteria (Environmental, Social, and Governance) to secure supply chain sovereignty and protect the dominance of the existing semiconductor oligopoly against rising state-sponsored competitors, particularly those in parts of Asia and the Global South. It's a masterclass in using "doing good" for competitive advantage.

The short-term impact is mixed, introducing significant supply chain friction. Costs will inevitably rise for downstream electronics manufacturers, squeezing margins across the tech sector. However, this is incredibly bullish for "pick and shovel" plays—companies providing green manufacturing technology, auditing services, or specialized compliance solutions. Raw material suppliers capable of meeting these stringent new rules will see their pricing power explode. Imagine being the only certified provider of a critical rare earth in a world demanding green credentials.

But the long-term implications are truly transformative. Despite initial supply-side friction, the ultimate outcome will be the bifurcation of the global tech stack. We are likely to see two distinct semiconductor supply chains emerge: a 'Green/Blue' chain of GSA-compliant, Western-aligned players, and a 'Red/Grey' chain featuring non-compliant entities focusing on lower-cost or legacy nodes. This is no longer merely about efficiency; it's about control. This deepens the technological "iron curtain," rendering global tech decoupling not just likely, but permanent.

The Road Ahead: Navigating the New Global Landscape

So, where do we go from here? What's the next domino to fall? In the immediate future, keep a vigilant eye on the foreign exchange markets. The unprecedented divergence between the BOJ's aggressive rate hike and the Fed’s dovish cut has put the US dollar under immense pressure. The next domino is likely a competitive reaction from export-dependent nations. The Eurozone, many emerging Asian economies, cannot afford their currencies to appreciate too rapidly against a weakening dollar and a strengthening Yen. This could ignite a new round of currency wars.

Here’s your essential watchlist:

- Carry Trade Liquidation: Monitor the VIX (the fear index) and liquidity in US credit markets. Continued Yen appreciation past key technical levels could trigger forced selling of US tech stocks to cover increasingly expensive Yen-denominated loans.

- Non-GSA Retaliation: Expect swift rhetorical or even trade-based retaliation from nations excluded by the 'Green Chip' standards. This could involve export restrictions on alternative critical minerals not covered by GSA agreements—a new resource war, cloaked in green rhetoric, could be imminent.

- US Inflation Expectations: With the Fed cutting rates despite persistently sticky "last mile" inflation, bond markets may begin pricing in a resurgence of inflation. This could lead to a 'bear steepening' of the yield curve—long-term rates rising even as short-term rates are cut—signaling a lack of confidence in the Fed’s ability to control prices.

This isn't just market analysis; it's a blueprint for the coming year. Everything you thought you knew about global finance and tech innovation is being rewritten. Tokyo, the silent giant, has awoken, and its actions are sending shockwaves across the globe. Stay vigilant, stay informed, and remember: adaptation is the only survival strategy in this new world.

|  |  |