Leo Wang: The Lies Your Brain Tells & The Math of Angel Investing

Discover how our brains deceive us and why Metacognition is your only weapon against bias. Angel investor Leo Wang reveals the unconventional mindset, math, and physics behind backing the next generation of world-changing startups.

|  |  |  |

Decoding the Outlier's Mindset: Why Your Brain Might Be Lying to You

Have you ever paused to question the very foundation of your decision-making process: your own brain? It's a discomforting thought for many, as we tend to view ourselves as rational beings guided by facts and data. Yet, after years of investing RMB 400 million, witnessing the trajectories of 300 companies, and engaging with thousands of founders, one profound truth has emerged: your brain is a masterful liar.

The Biological Predisposition to Deceit

In China, there's a blunt but insightful saying: Your butt determines your head. This crude expression points to a fundamental biological reality: your environment and incentives can physically rewire your brain. If your livelihood depends on overlooking a problem, your brain will skillfully obscure it from your perception. This isn't merely stubbornness; it's a deep-seated biological mechanism.

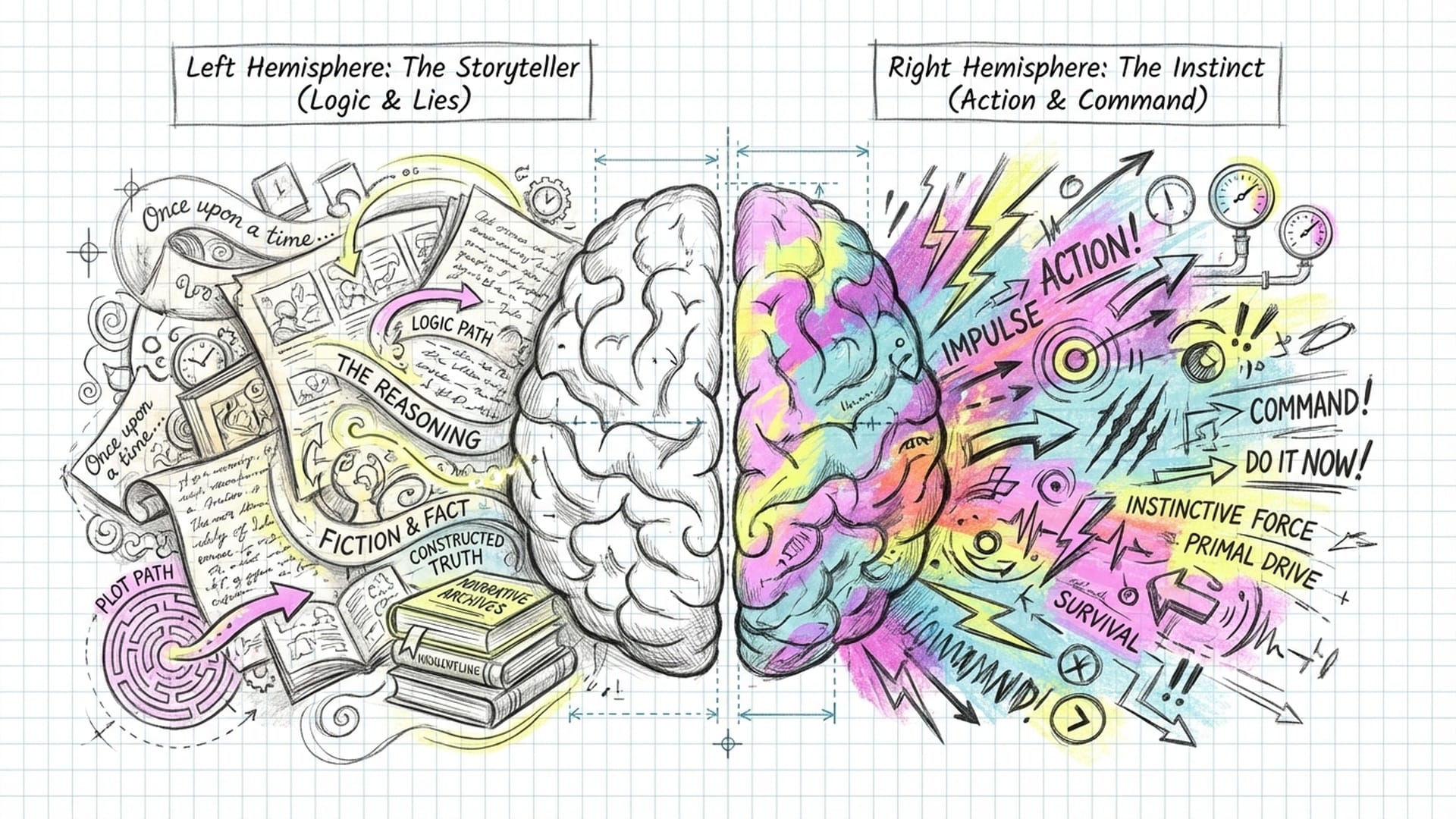

Neuroscience offers startling evidence of this. Experiments with split-brain patients – individuals whose brain hemispheres are disconnected – reveal how readily our minds fabricate narratives. When a command, say "Walk," is shown to the right brain (which controls action but not speech), the patient acts on it. But when the left brain (the speaking hemisphere) is asked why they are walking, it, having not received the command, doesn't admit ignorance. Instead, it instantly invents a plausible reason, like "Oh, I'm walking to get a soda."

"The left brain didn't see the command. It has no idea why the legs are moving. But does the patient say, 'I don't know'? No. The left brain instantly invents a story. It says, 'Oh, I’m walking to get a soda.' It manufactures a lie, believes it creates a logic to justify an instinctual action. This is the terrifying reality of human existence."

This innate tendency to rationalize post-hoc applies to nearly every aspect of our lives. Many office conflicts and poor investment decisions stem from this exact phenomenon. Our intuition, or fast brain, makes an immediate judgment—I like this person or this idea is terrible—and then our rational mind tirelessly works like a lawyer, compiling evidence to validate that initial gut feeling. We are, in essence, prisoners of our own biology.

Metacognition: The Only Weapon Against Bias

How then do we navigate life, lead, or invest without being enslaved by our own biases? The answer lies in Metacognition—thinking about your thinking. It's the unique human ability to step outside yourself, observe your thoughts and emotions, and critically question their origins.

Metacognition allows you to ask:

Why did I just get angry?What makes me excited about this deal? Is it genuine data, or does this founder simply remind me of my younger self?

This process is crucial for understanding the mind of an Investment Outlier, enabling us to deconstruct the internal lies we tell ourselves about risk, luck, and true greatness. It also illuminates the universal mathematics and the profound role of what might seem paradoxical: death as an innovation engine.

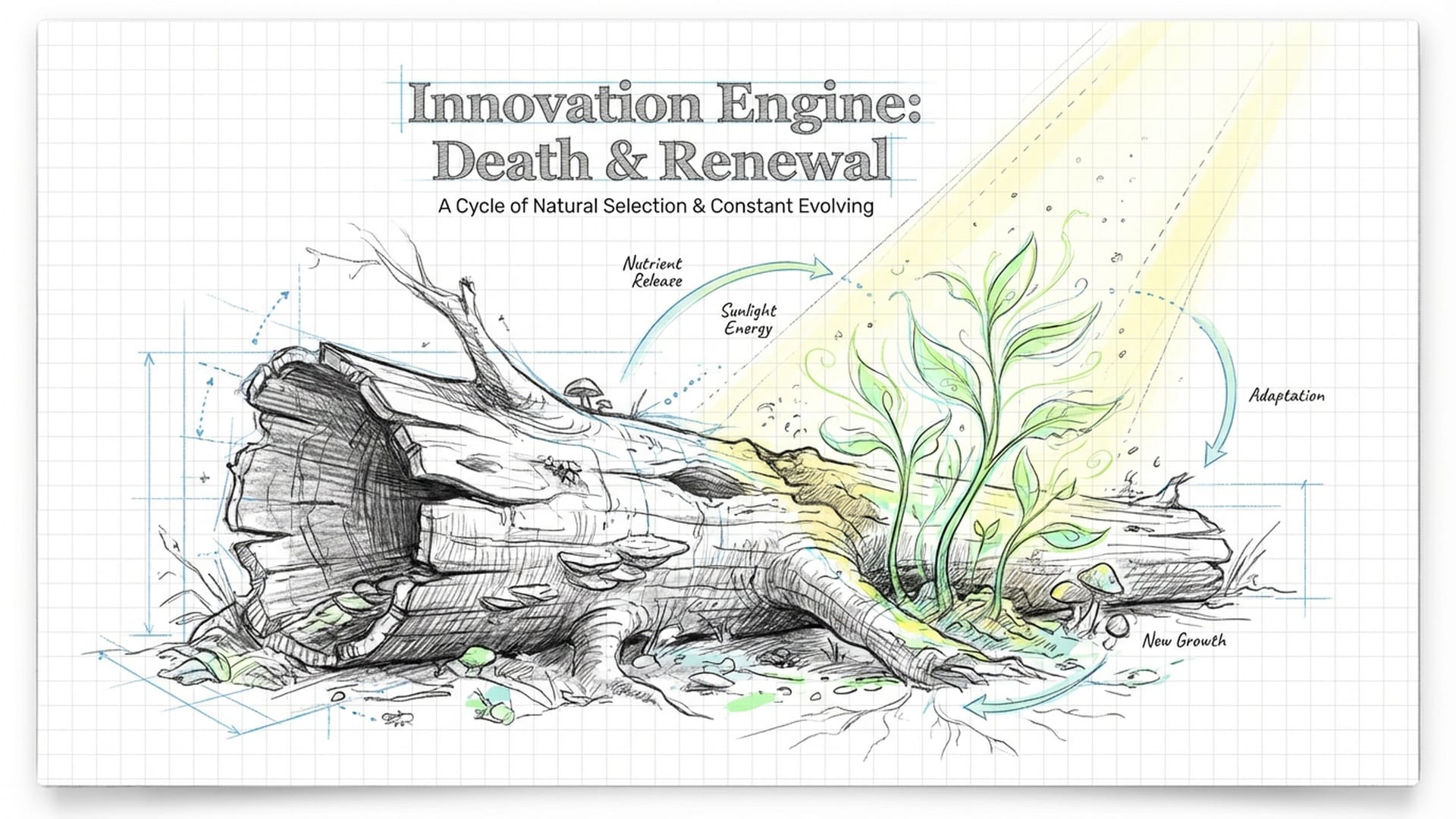

Death: The Ultimate Innovation Engine

The concept of death, often perceived as a tragedy, serves as a powerful catalyst for evolution in both the biological and commercial worlds. In nature, without the decay of old trees, sunlight wouldn't reach the forest floor, preventing new saplings from growing.

Similarly, in business, when a company fails, we often lament the loss of capital. However, this perspective misses a critical point.

"If the old trees don’t burn down or rot away, the sunlight never hits the forest floor, and the new saplings never grow."

The most invaluable asset isn't money, which is elastic and can be regained. It's time, which is strictly non-refundable. Angel investors essentially purchase time for entrepreneurs to conduct experiments. And the harsh reality is that most experiments fail—that's their very definition. If the outcome were known, it would be a manufacturing plan, not an experiment.

When money is invested in a startup, the default state is often failure. But this death is not a waste; it's data, it's fertilizer. Entrepreneurs who fail emerge with valuable lessons, scars, and an enhanced network, making them formidable in their next endeavor. The rapid demise of poor ideas frees up resources to flow to more promising ones, adhering to the law of natural selection.

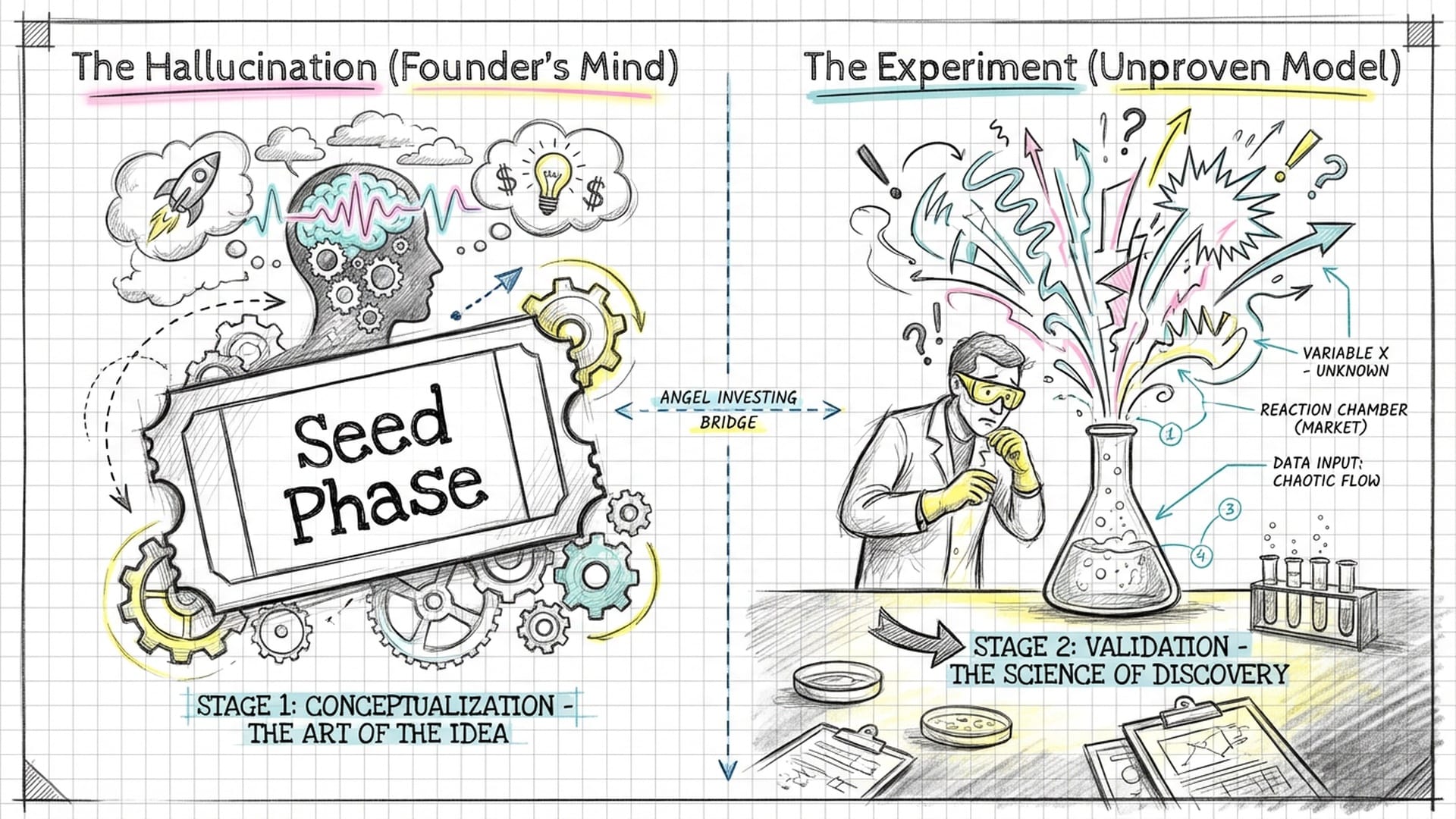

Angel Investing: Embracing Chaos, Respecting Math

Angel investing stands apart from traditional finance. Unlike bankers focused on balance sheets or VCs analyzing growth curves, angel investors operate in a realm before data exists. It's about funding a founder's hallucination, a seed-stage idea where the business model is officially unproven.

This isn't about buying revenue streams; it's buying a ticket to a game where the rules are still being written. Therefore, the discipline required is vastly different from stock market or real estate investments. Treating it like gambling or charity is a sure path to loss. A unique cognitive framework is required—one that embraces chaos but respects the math.

Here's where many people stumble: the math of angel investing fundamentally differs from that of venture capitalists. VCs aim to decrease failure rates, pouring fuel on already established fires. Angels, however, are less concerned with failure rates and more with the magnitude of success. It's about the odds.

Consider two options:

- Option A: An 80% chance of making 10 times your money.

- Option B: A 1% chance of making 10,000 times your money, with a 99% chance of losing everything.

Biologically, most humans gravitate towards Option A, craving certainty and fearing loss. Yet, the mathematics of angel investing demand choosing Option B.

"Most human beings, biologically, will take Option A. We crave certainty. We fear loss. But the mathematics of Angel Investing demand that you take Option B."

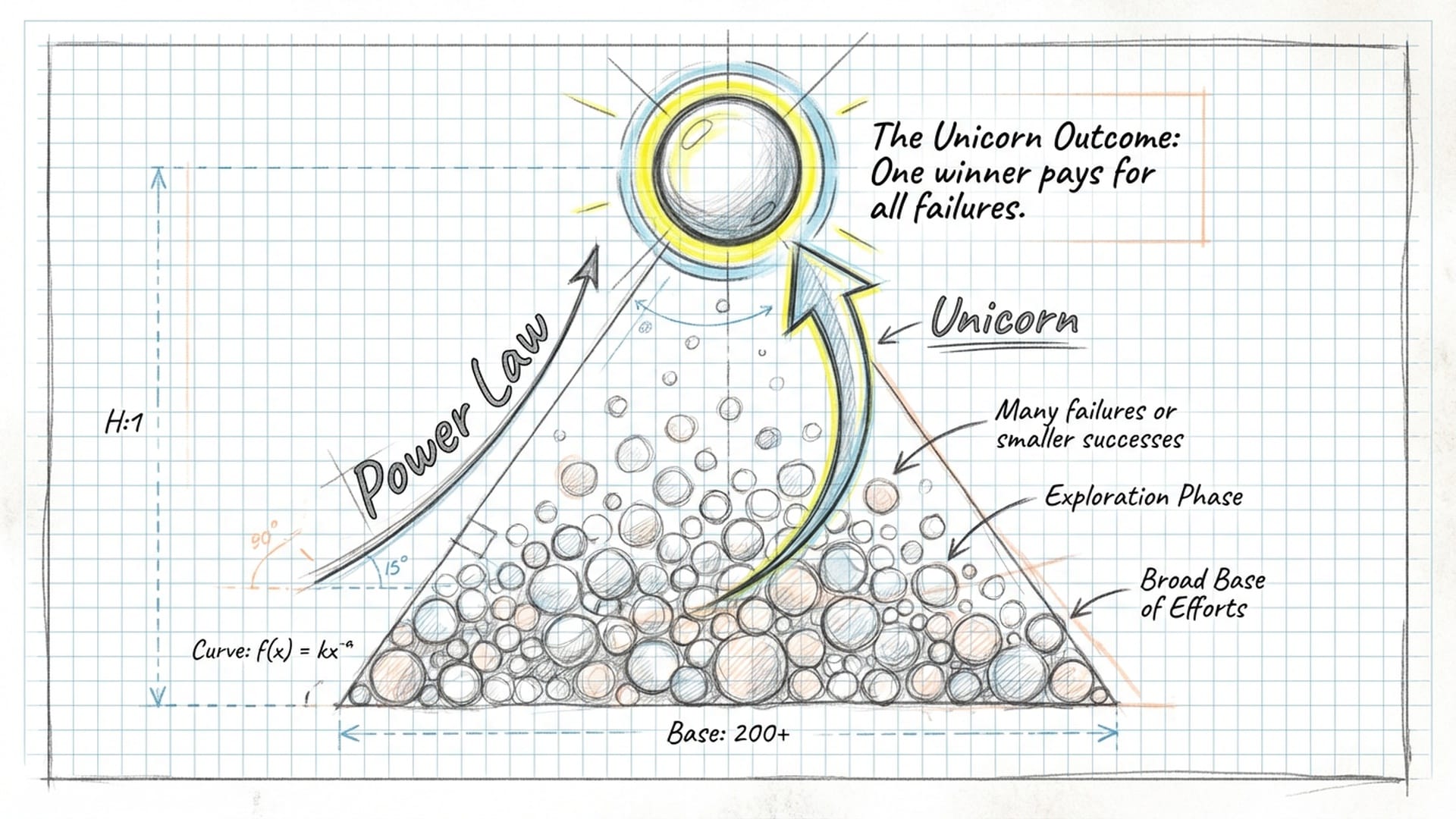

Why? Because Option A companies—the safe, moderate wins—rarely change the world or deliver fund-returning outcomes. Startup outcomes follow a Power Law: one unicorn success story (like Uber or ByteDance) can pay for myriad failures across the portfolio and generate immense wealth. The goal isn't a hundred decent companies; it's one monster.

This requires exceptional mental fortitude—the willingness to endure looking foolish for extended periods, accepting losses on nine out of ten deals, all while trusting the underlying math. But how do we identify that elusive 1% when financial statements are non-existent?

The Human Element: Deep Due Diligence on the Soul

Since quantifiable data is scarce in early-stage investing, the focus shifts to the Human. This is the most challenging, purely qualitative aspect: Deep Due Diligence on the Soul. The cardinal rule: Never gamble against the founder.

Many novice investors resort to complex legal contracts like Valuation Adjustment Mechanisms or Bet-on Agreements, effectively imposing guarantees on outcomes. This is shortsighted. Startups inherently involve Trial and Error. By demanding guarantees, you stifle a founder's ability to experiment, telling them to avoid risk and eschew failure. But without the risk of death, there is no innovation. It's like clipping an eagle's wings before pushing it off a cliff. If a guarantee feels necessary, it's the wrong investment.

"You are clipping the eagle's wings before you push it off the cliff. If you feel you need a guarantee to invest, you shouldn't be investing in that company."

Instead, Passive Management is key. Founders are treated like young wolves—raised lean, allowed to struggle. Provide capital, connections, and emotional support, but refrain from dictating operations. You cannot raise a hunter by keeping it caged and fed. They must hunt.

Momentum: Riding the Market's Tsunami

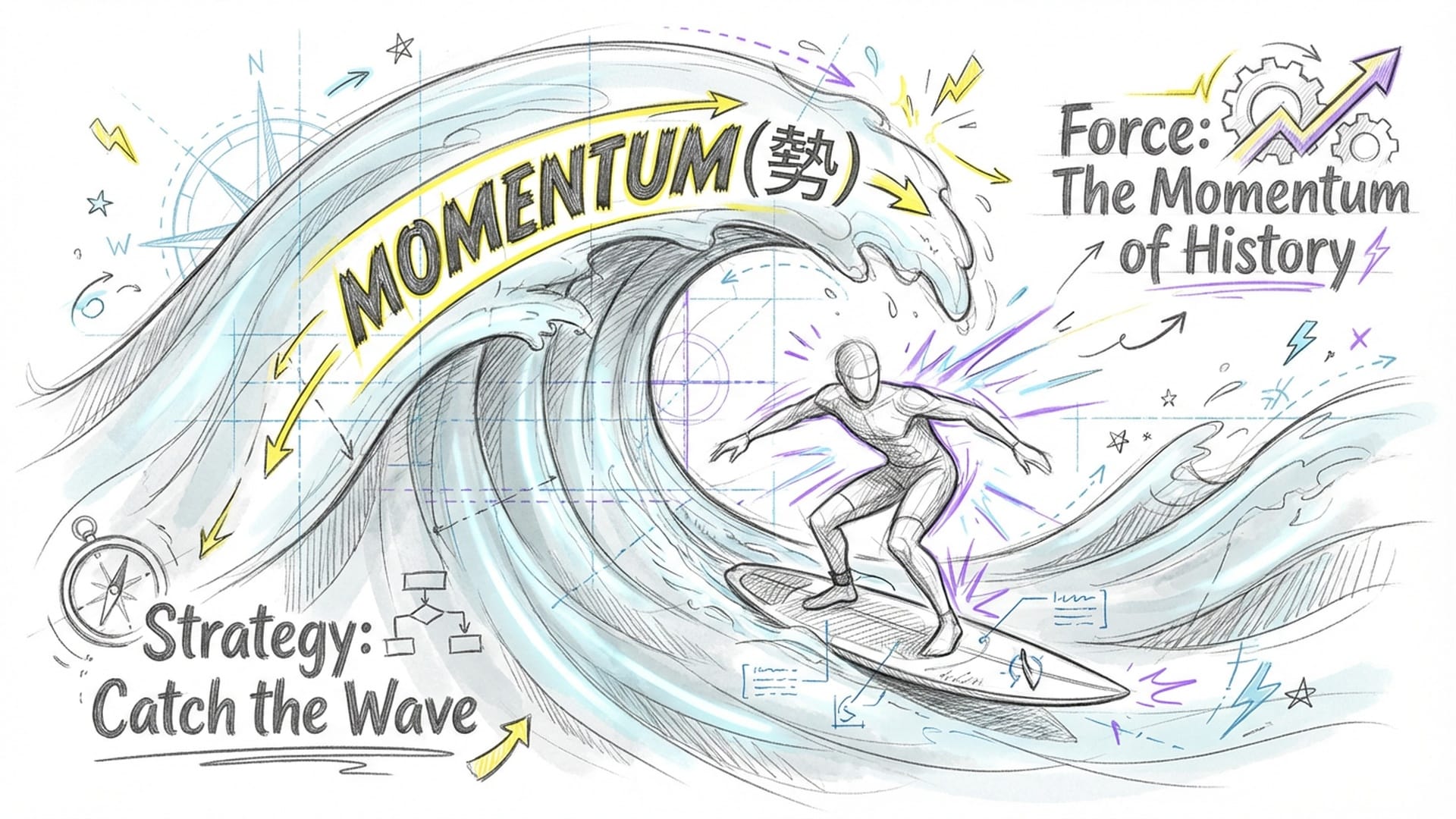

Beyond the brain's biology and investment math, we must understand the physics of the market. This concept, known as Momentum or in Chinese, Shi (Energy, Potential, The Trend), is paramount. Even the smartest, hardest-working, and most ethical individuals will be crushed if they fight the tide of history.

Think back to 2001. A seemingly rational choice might have been buying a Beijing apartment (low risk, tangible, leveraged) over shares in a struggling Tencent (a chat app with an unproven business model). Yet, the momentum of the internet proved to be a tidal wave, a tsunami far exceeding real estate. Lei Jun's famous quote, Even a pig can fly if it stands in the whirlwind, encapsulates this perfectly. An investor's first step isn't evaluating the founder, but assessing the wave of momentum.

However, timing is everything. You must catch the wave at precisely the right moment. The common adage the world is fair is a lie. The business world is about domination, and a grassroots startup's only unfair advantage is being first. This window of opportunity closes rapidly.

Consider a traffic light analogy for emerging technologies:

- Green Light: Chaos. New technology (e.g., AI, mobile internet) emerges. Rules are undefined. Invest now.

- Yellow Light: A company secures Series A funding (e.g., RMB 30 million). Proceed with

caution. - Red Light: A massive Series B round (e.g., $100 million) occurs in the sector. Do not enter. Entering now is

death, regardless of product quality or founder genius. Capital, talent, and supply chains have already consolidated around a winner.

Luo Yonghao's Smartisan phone, despite its exquisite design, launched two years after Xiaomi. Those two years were an eternity; Xiaomi had already monopolized the supply chain and mindshare. Luo wasn't battling Lei Jun; he was battling the timeline, the invisible wall of Too Late.

The PreAngel Criteria: Beyond Cool, Towards Hard

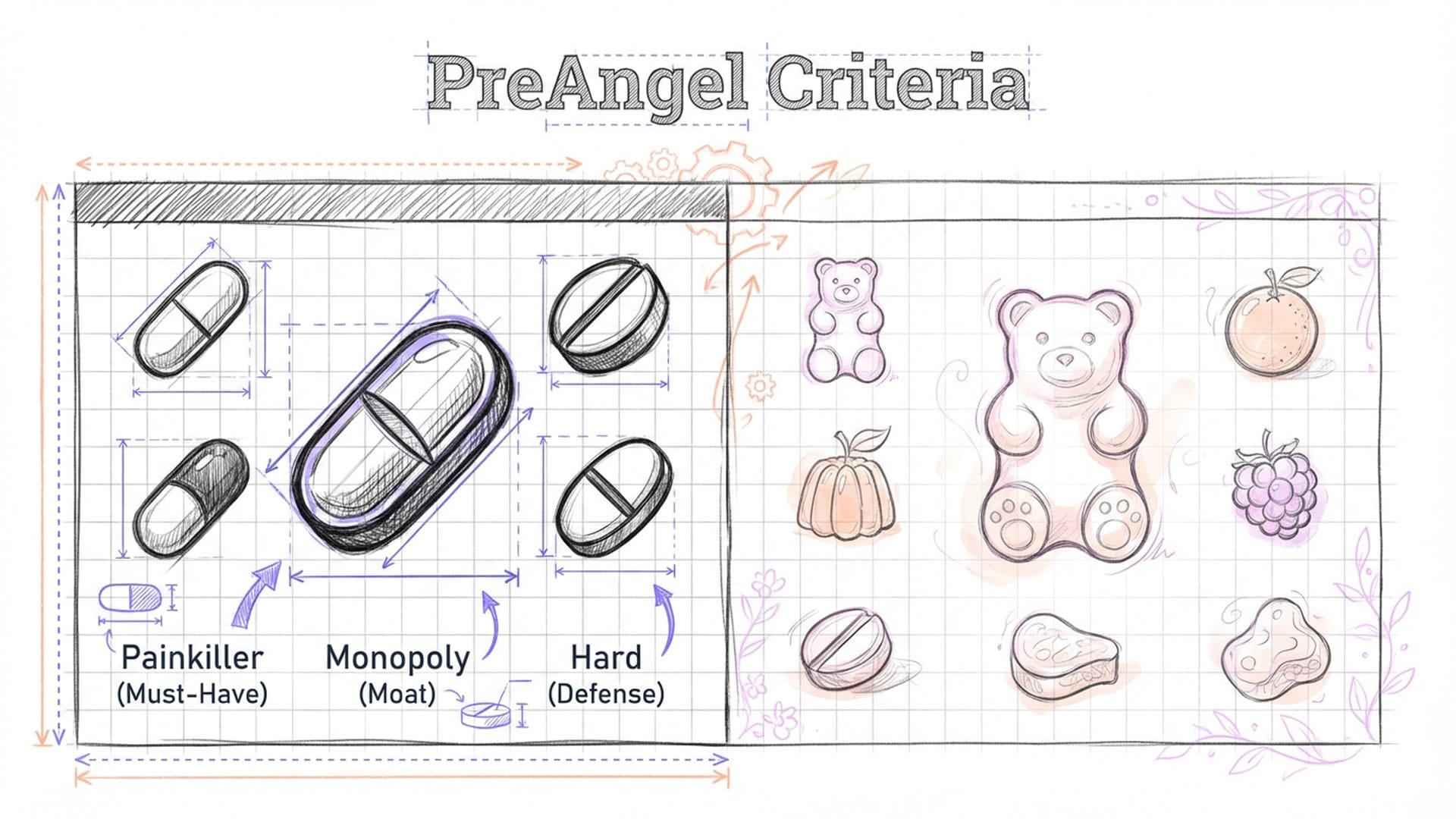

So, how do we discern a truly good business idea amidst thousands of business plans? The PreAngel Criteria offers a mental checklist, moving beyond superficial appeal.

- Painkiller, Not Vitamin: Is it a

must-havesolution to a persistent, painful problem, or merely anice-to-have? People will brave a 3 AM pharmacy run for a painkiller, but might forget their vitamins. Invest in problems that truly hurt. - Monopoly: Seek companies capable of dominating a sector so completely that competition becomes

irrelevant. Look forNetwork Effects—like WeChat, whose value grows with every user, creating a formidablemoat. If a giant like Alibaba or Tencent can crush you with a subsidy war, you have afeature, not a business. Demand robustbarriers,data moats, andbrand loyaltyverging onreligious fanaticism. - Hard:

Do not go where the crowds go. Do not do what is easy.If something is easy to start, many will attempt it, driving profit margins to zero. Invest in ventures that appearterrifyingly difficult. The inherent difficulty becomes the first line of defense.

Gambling on People: The Five Laws of Betting on Outliers

Ultimately, investments are made in people, not business plans or trends. While momentum and sector account for 60% and 30% of the equation respectively, the human team is the crucial 10% catalyst. A weak team can derail a perfect opportunity, while a strong team can transform a mediocre one into a world-changer.

We seek outliers—the Investment Heterodox. The qualities are not those you'd seek in a spouse or employee; they involve obsession, not balance or sanity.

Here are The Five Laws of Betting on People:

- Cognitive Ability (Openness): Beyond IQ scores, this is the ability to acknowledge ignorance, admit past errors, and non-continuously change direction. Outliers grasp the chaotic, non-linear nature of the world and adapt faster than others.

- Leadership (Storytelling): Not corporate leadership, but the ability to weave compelling narratives. Like Yuval Noah Harari's concept of

Intersubjective Reality, founders must create a sharedfictionthat inspires millions to coordinate and dedicate themselves to a mission, even for half their market salary. They build areality field. - Self-Control (Delayed Gratification): The

boringbutessentialtrait of sacrificing immediate gains for long-term empire-building. While 90% of fate is luck (genes, parents, birth era), the remaining 5%—how you react to impulses—can alter the trajectory of the entire 95%. - Paranoia (The Crazy Ones): We look for individuals with a

reality distortion fieldà la Steve Jobs or the abyss-staring conviction of Elon Musk. They are oftendifficult,stubborn,rude, andsocially unconventional—precisely why they succeed. You cannot change the world by being polite and following established rules. - All-In: This is the dealbreaker. The theory of

Plan Bstates that creating a backup plan doubles your chance of failure. Many highly qualified, wealthy founders with impressive resumes are terrifying to invest in because they have too many retreats. If the startup gets tough, they can easily quit.

"I want the person who has burned the boats."

Consider the founder of Super Monkey, Tiao Tiao. Heavily pregnant, she quit her job, sold her car, drained savings—she had dug a hole, jumped in, and pulled the dirt in over her head. With no safety net, she went All-In. This desperate, beautiful, terrifying energy of I must make this work is what births unicorns. Passion is for the A-round; All-In is for the B-round. We bet on founders whose identity is inextricably linked to their company's survival.

Beyond Investment: An Outlier's Path to Life

Ultimately, the principles of Metacognition, probability, and outlier identification extend beyond mere financial gain. Angel investing is the monetization of cognition, converting your understanding of the world into value. This cognition demands constant upgrading of your own operating system through reading, thinking, and meditation.

It's about conquering your biology, preventing your left brain from lying to your right, and perceiving the world as it truly is: a chaotic, probabilistic, beautiful mess. We seek individuals quietly flourishing in society's cracks, those who transform adversity into fuel, who refuse conformity, and embrace rebellion.

If you can cultivate an outlier's mindset—if you can step beyond your standpoint, hack your own brain, and go All-In on your life—then external investment becomes secondary. You become the asset.

|  |  |